Dignity starts with a job

2 minsUpaya Social Ventures (Upaya SV) was founded 12 years ago to create dignified jobs for people living in extreme poverty by building scalable businesses with investment and consulting support. Upaya is as old as this blog :) and featured in my initial list of minuscule impact investors.

Upaya SV has a unique approach to philanthropy, which they term “Recycled Philanthropy.” This concept is about making impactful investments rather than providing traditional grants. Their primary value proposition is to use their capital to create more dignified jobs and transform lives, particularly in India, by investing in early-stage companies. They aim for the capital to multiply its impact, rather than being a one-time grant.

Here’s how they define their target segment (their “portfolio partners”):

Although small and growing businesses (SGBs) like our portfolio partners create more than 60% of India’s new jobs, they often fall in the “missing middle” when it comes to raising capital: too large for microfinance loans, but not yet large enough for traditional funders.

Impact

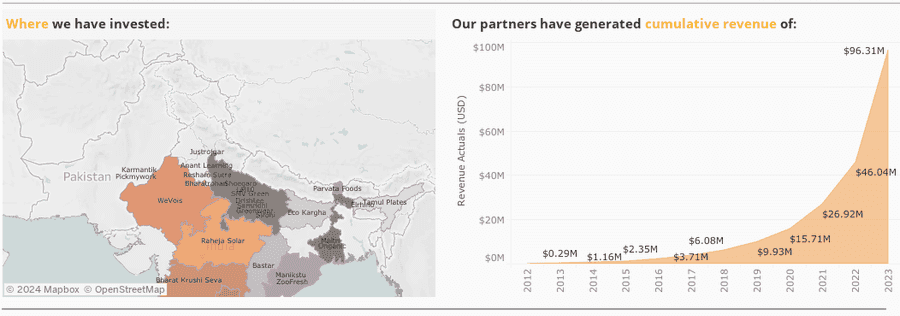

Impact in one sentence - 35K dignified jobs created via 38 portfolio partners. Highlighting key trends from the portfolio dashboard page

- Cumulative investment of $1.48 million to date

- Upaya’s investment in portfolio companies, on average, represents 19% of total capital

- Companies have raised 16X on average in follow-on investment

- Top 4 sectors: Food & Agri, Textiles & Apparel, Skill Development, Waste Mgmt & Sanitation

- Every $1 they invest generates $3 in income for jobholders, their families, and communities

The portfolio companies range from haqdarshaks (a rural gig worker platform that enables millions of families to avail government subsidy programs efficienctly) to Hasiru Dala (rag pickers collective in Bangalore) to Saahas Zero Waste (turning former rag pickers to employees with benefits) to SMV Green (provides rent-to-own financing for EV auto rickshaw drivers).

(Upaya Impact Dashboard - partial)

(Upaya Impact Dashboard - partial)

Upaya Next & DAFs

In a Jun ‘22 blog post, Upaya’s CEO Kate Cochran writes about returning money to its donors, 11 years after starting their journey. At first blush, this sounds like a venture fund returning money to its LPs. But.. the differences lie in investor donor persona and the type of returns they are seeking. Upaya’s donors are individuals or philanthropic foundations who invest via a Donor-Advised Fund (DAF). A DAF is a philanthropic vehicle established at a public charity and allows donors to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time. The funds can be invested, and any investment growth is tax-free.

Upaya raised $3 million as part of its second pool of recoverable grants. The pool will fund Upaya’s investments in India as well as a potential geographic expansion. Grants will be repayable to donors based on overall portfolio performance, up to a return of 5% over the original amount. Wishing Upaya and its portfolio companies the very best.